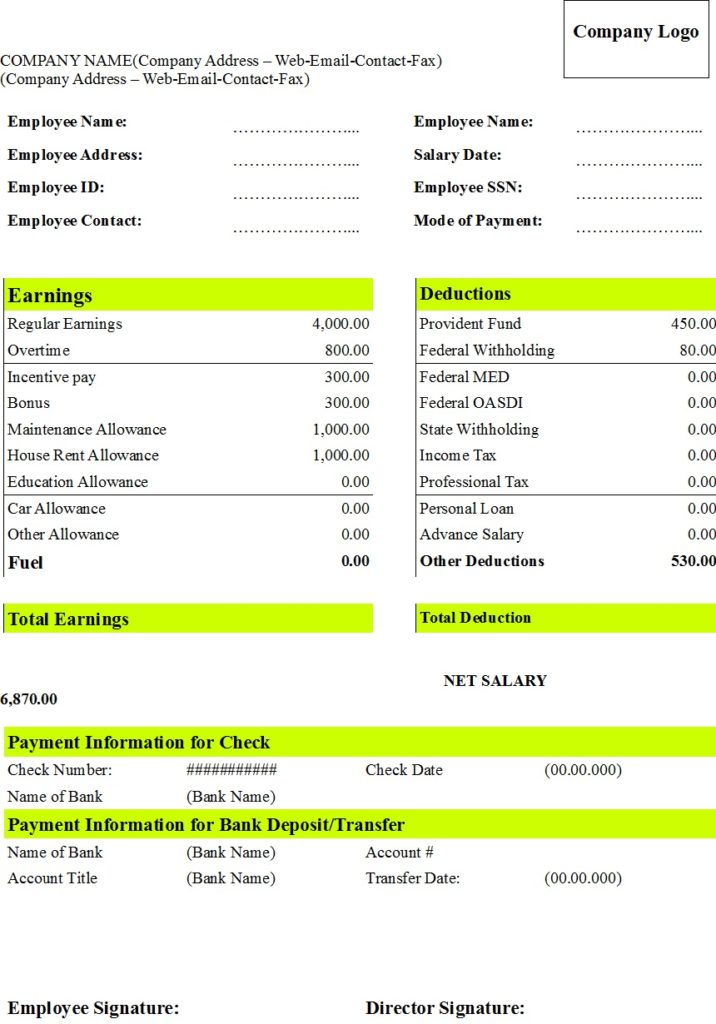

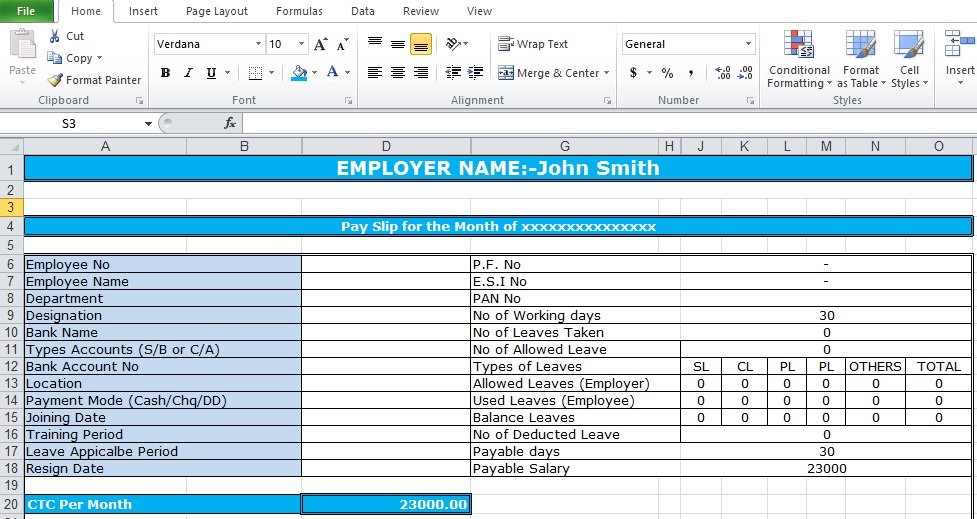

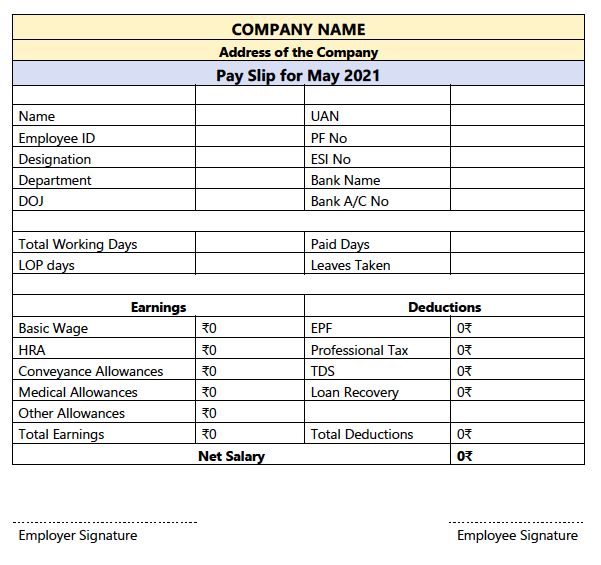

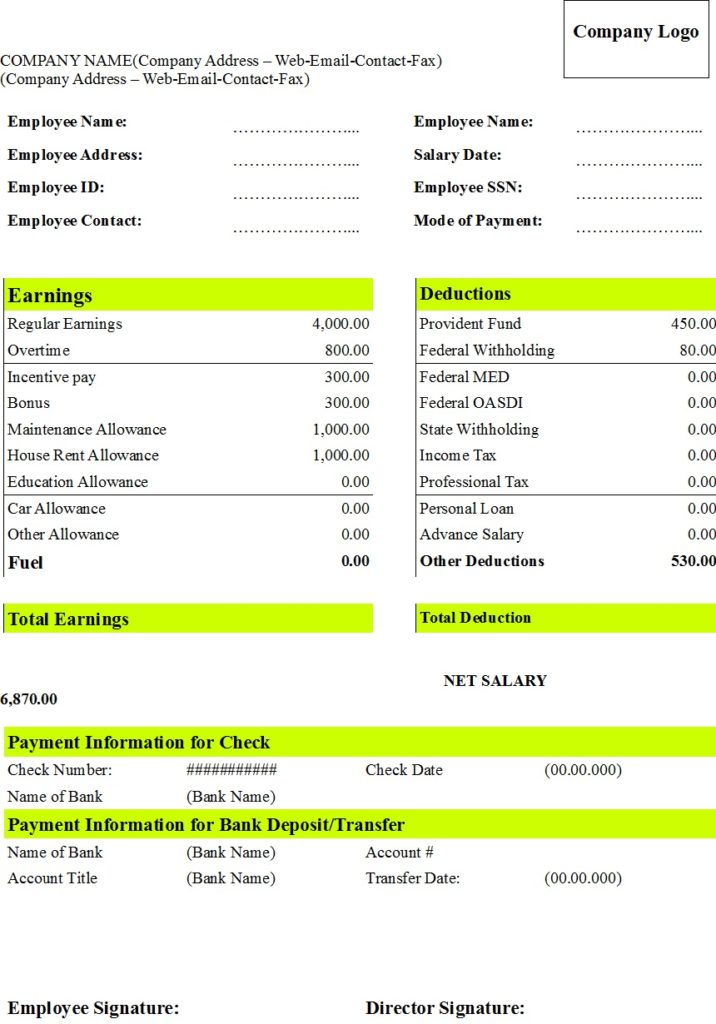

Income tax: Individual and company income are subject to income tax, which is a kind of tax imposed by governments on the revenue produced by companies and people within their jurisdiction. In the same vein, the employer equally contributes to the plan on their employees' behalf, as explained above. EPF: The Employee Provident Fund is a retirement savings plan into which workers of a company make monthly contributions equal to a modest percentage of their basic salary. Essentially, it is a kind of risk management that is mainly used to protect against the possibility of a future or unknown loss. Insurance: An insurance policy is a method of protecting yourself against financial loss. As the name implies, Leave Travel Allowance refers to an employee's allowance while travelling with their family or by themselves. It is a tax break provided by a company to its workers. LTA: Leave Travel Allowance is one of the most effective tax-saving measures available that can benefit Employees. HRA: House Rent Allowance is a compensation component given by employers to workers to cover the cost of renting a property for residential reasons. It can include tasks beyond their regular working hours and beyond the agreed-upon time frame. Overtime: When an employee works extra hours, this is known as overtime. Bonus: A bonus is the sum of money added to a person's wages to reward outstanding performance. It excludes dividends, benefits, overtime pay, or any other potential reward from an employer.

Income tax: Individual and company income are subject to income tax, which is a kind of tax imposed by governments on the revenue produced by companies and people within their jurisdiction. In the same vein, the employer equally contributes to the plan on their employees' behalf, as explained above. EPF: The Employee Provident Fund is a retirement savings plan into which workers of a company make monthly contributions equal to a modest percentage of their basic salary. Essentially, it is a kind of risk management that is mainly used to protect against the possibility of a future or unknown loss. Insurance: An insurance policy is a method of protecting yourself against financial loss. As the name implies, Leave Travel Allowance refers to an employee's allowance while travelling with their family or by themselves. It is a tax break provided by a company to its workers. LTA: Leave Travel Allowance is one of the most effective tax-saving measures available that can benefit Employees. HRA: House Rent Allowance is a compensation component given by employers to workers to cover the cost of renting a property for residential reasons. It can include tasks beyond their regular working hours and beyond the agreed-upon time frame. Overtime: When an employee works extra hours, this is known as overtime. Bonus: A bonus is the sum of money added to a person's wages to reward outstanding performance. It excludes dividends, benefits, overtime pay, or any other potential reward from an employer.

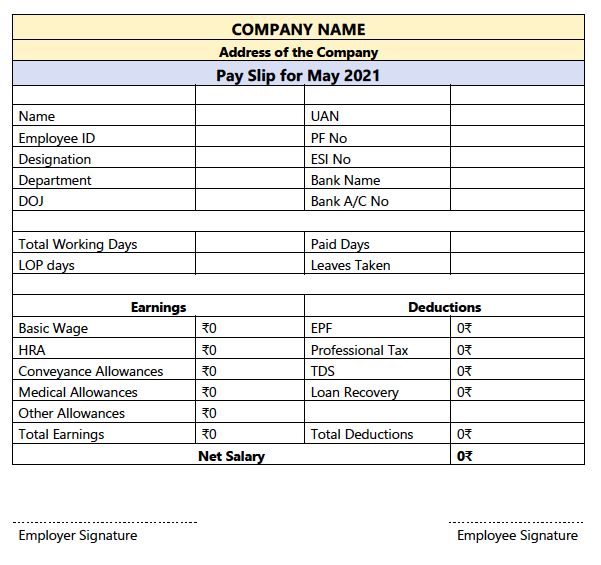

The total amount comprises the take-home pay. It includes the amount an employee receives before any extras are added or payments deducted. Basic Salary: Basic salary is the amount of money agreed upon by an employer and employee.

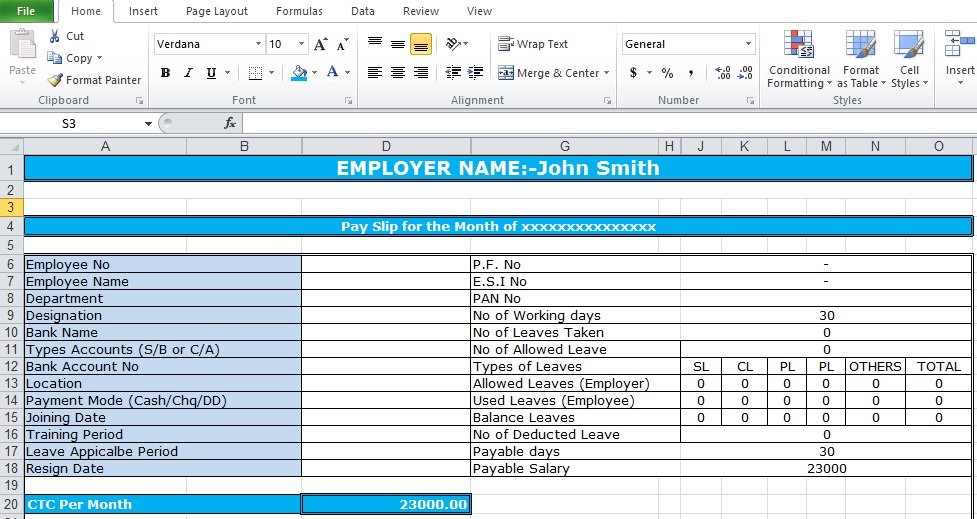

It contains employee details and payslip details Salary Content Earnings examples: The header section can have the details contains title, company name and company address Employee / Payslip Info

0 kommentar(er)

0 kommentar(er)